The Truth Behind a Public Takeover for Long Islanders

Long Islanders pay some of the highest taxes in the country.

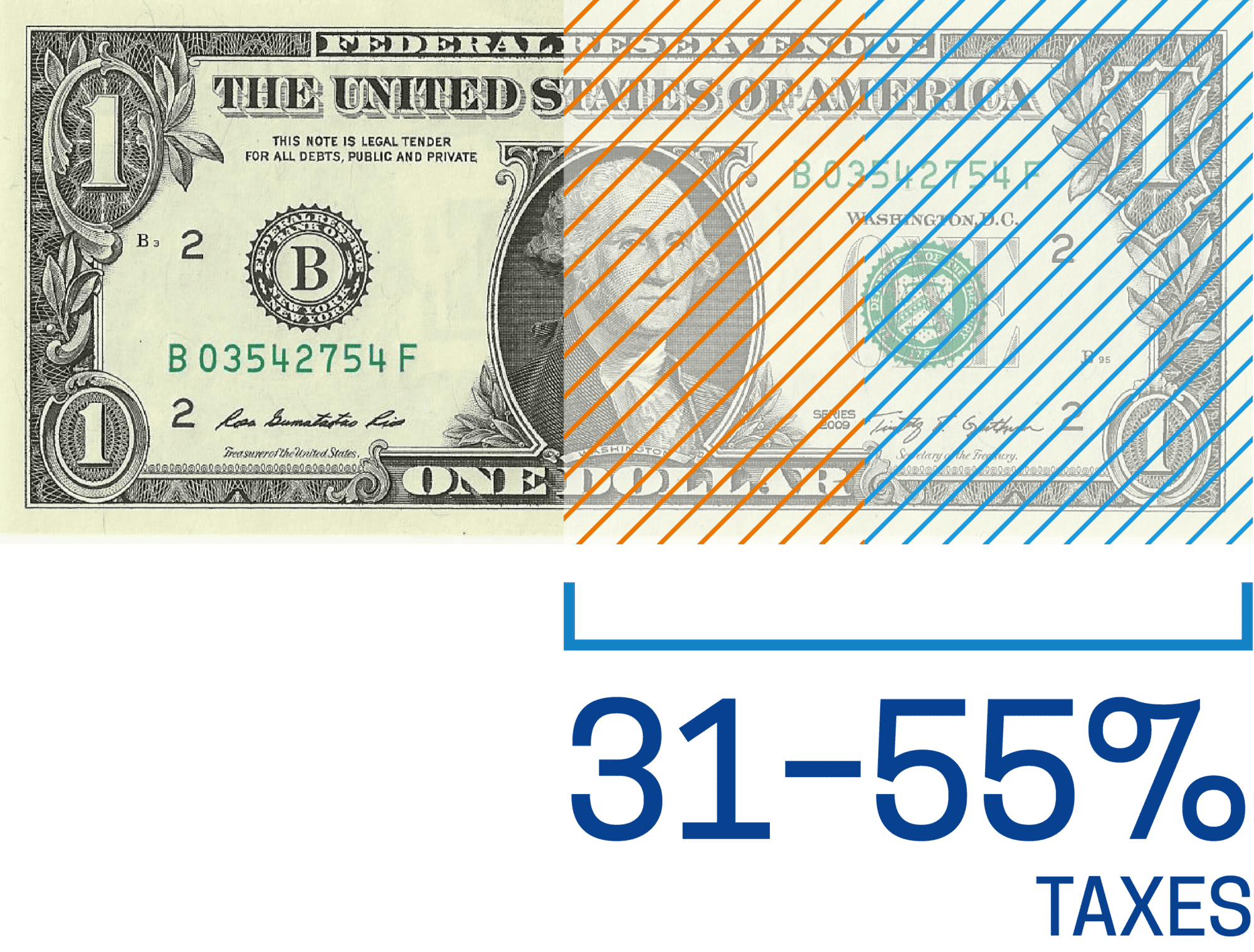

Today, there is a special franchise tax that is only applied to private water companies in New York. That extra tax accounts for 31-55% of water bills, leading to high costs during a time when residents are trying to recover from the economic impacts of COVID-19.

We need solutions that will provide relief to Long Island residents.

Lawmakers can bring rate relief to Long Islanders by removing the special franchise tax on private utility companies and their customers.

THE FACTS ABOUT A PUBLIC TAKEOVER

| FACT | FACT | FACT |

|---|---|---|

| A public takeover could cost taxpayers on Long Island thousands of dollars. Contested takeovers of private water companies are very costly for the acquiring government entity and do not necessarily result in lower rates. Instead, these financial obligations are passed along to customers. | A public takeover could cost taxpayers on Long Island thousands of dollars. Private water companies invest in critical infrastructure at levels far higher than their municipal counterparts. Private water companies have the capacity to continuously improve treatment and distribution facilities. | Private water companies employ a local workforce to repair or replace water infrastructure. If these projects decrease due to a public takeover, so do local job opportunities. A public takeover directly threatens the livelihood of Long Islanders. |

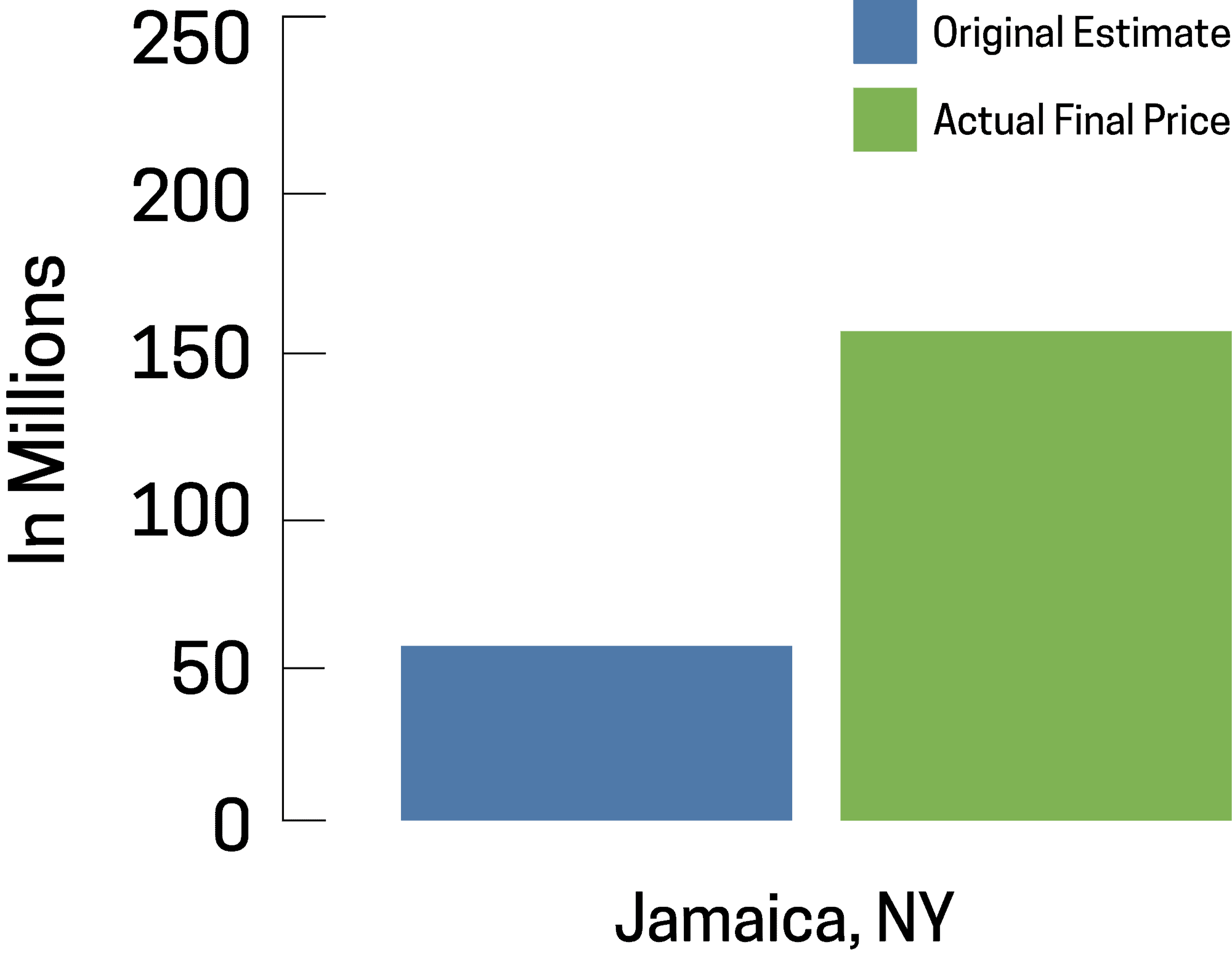

Activists Underestimate Condemnation Costs

Activists supporting a public takeover use low-ball estimates to justify trying to take over water systems. Government takeovers end up costing many times more than originally estimated, and taxpayers end up paying for all of it.

Taxes on Long Islanders’ Water Bills